Introduction:

Welcome to the realm of Individual Savings Accounts (ISAs), a valuable resource for UK residents seeking tax-efficient methods to save and invest their earnings. Whether you are a novice or a seasoned investor, comprehending ISAs can revolutionize your financial journey. In this guide, we will delve into everything you need to know about ISAs in the UK, from the fundamentals to advanced strategies.

What is an ISA?

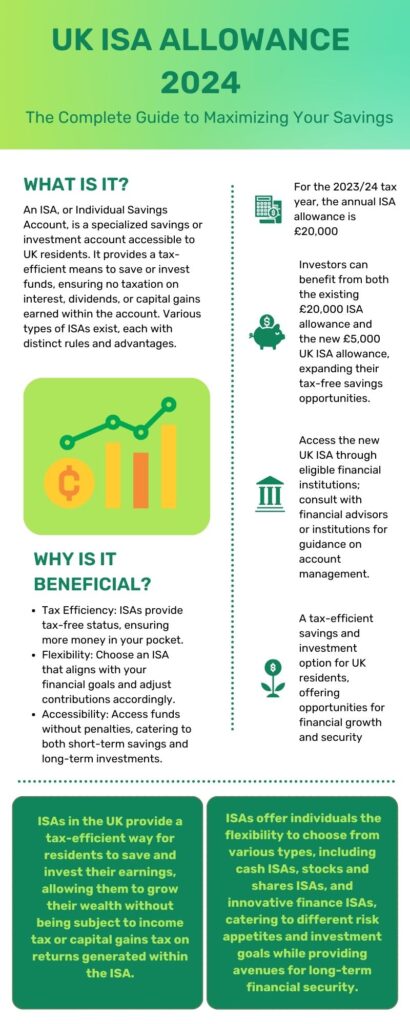

An ISA, or Individual Savings Account, is a specialized savings or investment account accessible to UK residents. It provides a tax-efficient means to save or invest funds, ensuring no taxation on interest, dividends, or capital gains earned within the account. Various types of ISAs exist, each with distinct rules and advantages.

Explore our free of cost ISA calculator today!

Types of ISAs:

Cash ISA:

This mirrors a traditional savings account but offers tax-free interest on your savings.

Stocks and Shares ISA:

Ideal for those seeking to invest in stocks, bonds, or mutual funds without tax implications on gains.

Innovative Finance ISA (IFISA):

Allows for tax-free returns on ventures like peer-to-peer lending or crowdfunding.

Lifetime ISA (LISA):

Tailored for individuals aged 18 to 39 aiming to purchase their first home or save for retirement, with added government bonuses.

Benefits of ISAs:

- Tax Efficiency: ISAs provide tax-free status, ensuring more money in your pocket.

- Flexibility: Choose an ISA that aligns with your financial goals and adjust contributions accordingly.

- Accessibility: Access funds without penalties, catering to both short-term savings and long-term investments.

FAQs (Frequently Asked Questions):

Q: How much can I put into an ISA?

For the 2023/24 tax year, the annual ISA allowance is £20,000. You can divvy up this allowance however you like between different types of ISAs.

Q: Can I move money between different types of ISAs?

Yes, You can transfer funds between different ISAs without eating into your annual allowance. Just make sure to follow the specific rules and procedures for each type of ISA.

Q: Are there any penalties for withdrawing money from an ISA?

Generally, you can withdraw funds from an ISA whenever you want without facing any penalties. However, if you have a Lifetime ISA and withdraw early for reasons other than buying your first home or retirement, you may incur a penalty.

Q: What is the new UK ISA introduced in Spring Budget 2024?

The new UK ISA, announced in Spring Budget 2024, offers an additional tax-free savings opportunity for individuals to invest in the UK while supporting UK companies. It provides a separate £5,000 annual allowance, in addition to the existing £20,000 ISA allowance.

Q: How does the new UK ISA benefit investors?

Similar to other ISAs, investors under the British ISA will not incur tax on capital gains or income. The introduction of this new ISA expands tax-free savings opportunities and encourages investment in UK-based assets.

Q: Can investors utilize both the existing ISA allowance and the new £5,000 UK ISA allowance 2024?

Yes, investors can take advantage of both allowances. The existing £20,000 ISA allowance remains available, and individuals can now also utilize the new £5,000 UK ISA allowance, effectively increasing their tax-free savings potential.

Q: Are there any restrictions on the types of investments allowed within the new UK ISA?

Details regarding specific investment options within the new UK ISA are yet to be disclosed. However, similar to other ISAs, it is expected to accommodate a range of investment choices while maintaining tax-free status on capital gains and income.

Q: How can individuals access the new UK ISA?

The new UK ISA will be accessible through eligible financial institutions offering ISA products. Interested individuals should consult with their financial advisors or respective financial institutions for further guidance on opening and managing their UK ISA accounts.